NOVARESE INVESTOR RELATIONS SITE

Our Strategies

New store opening strategy

Currently, we are opening stores and venues primarily in regional cities with populations ranging from around 250,000 to one million. To balance the opening of a large number of stores with the maintenance and improvement of added-value services, we plan to continue opening three new stores each year, with consideration for both the hiring and training of talented staff and financing to secure cash flow. In addition to opening new stores on vacant lots on our own, we also expect to accelerate store openings in various formats in the future, including acquisitions of other companies in the same industry that are struggling in rural areas, store acquisitions, and leasing of vacant properties.

Current store openings in Japan (wedding based)

Store openings in Japan

Stores opened mainly in cities with populations of 250,000–1,000,000

Avoiding the Tokyo metropolitan area,

which has excessive competition and heavy rent burdens, to ensure profitability

which has excessive competition and heavy rent burdens, to ensure profitability

Four brands: Monolith (urban), Amandan (suburban), Flairge (renovated),

and Kirana Resort (resort-type)

and Kirana Resort (resort-type)

For relatively large cities, multiple brands are opened at the same time

1 store

2 stores

3 stores

Not yet opened

* Source: Ministry of Internal Affairs and Communications (MIC) announcement,

January 1,

2024: Basic resident register population / number of households

January 1,

2024: Basic resident register population / number of households

*Including planned opening locations

List of our venues in Japan

* Source: Ministry of Internal Affairs and Communications (MIC) announcement, January 1, 2024: Basic resident register population / number of households

*Including planned opening locations

Room to open new stores in Japan

We will focus on opening stores / venues in regional city areas where there is ample room for store openings, based on careful examination of areas where we can expect high investment efficiency. We have currently opened stores in 19 of the 78 cities we are focusing on. Considering that we can open 2–3 stores / venues per city, we believe that there is plenty of room to open new stores / venues.

Future store opening strategy

New store opening strategy

- We will continue to open new stores / venues in vacant lots, mainly in regional city areas.

- We will open stores in various formats, including acquisitions of other companies in the same industry that are struggling in rural areas, store acquisitions, and leasing of vacant properties.

Annual store opening plan: around 3 stores / venues

The pipeline of candidate locations for store openings is abundant, and we have continued to open stores steadily while carefully examining investment efficiency.

(Initial investment: around 800 million yen, recovery period: within 5 years) (Annual sales target per typical facility: approximately 500 million yen)

(Initial investment: around 800 million yen, recovery period: within 5 years) (Annual sales target per typical facility: approximately 500 million yen)

Store opening environments in major cities and regional cities

Number of cities nationwide and room for store openings

* Source: Ministry of Internal Affairs and Communications (MIC) announcement, January 1, 2022: Basic resident register population / number of households, 2021 (January 1 through December 31, 2021) demographics (by municipality)

Regeneration and M&A backed by extensive know-how

We have a track record of renovating and reviving unprofitable old-style wedding venues, hotels, and historical buildings by injecting our human resources development and in-house production expertise. We will continue to work actively on these renovation and M&A projects because they have a relatively short development period and allow us to open stores while keeping initial investment costs low.

Examples of renovation of historical buildings

MITAKISO

Hiroshima, Hiroshima Prefecture

[Former Ryotei & Ryokan

(Traditional Japanese-style

Restaurant and Hotel)]

[Former Ryotei & Ryokan

(Traditional Japanese-style

Restaurant and Hotel)]

- Awarded the 12th Hiroshima Urban Development Design Award

- This Japanese-Western design building was constructed during the early Showa period and opened in 1946 as a ryotei and ryokan (traditional Japanese-style restaurant and hotel).

- In 2009, it was renovated with the theme of “Japanese Modern,” as a wedding facility where guests can discover fresh Japanese style, incorporating elements of modern art while retaining the architectural beauty of the original period, such as the Ajiro ceiling.

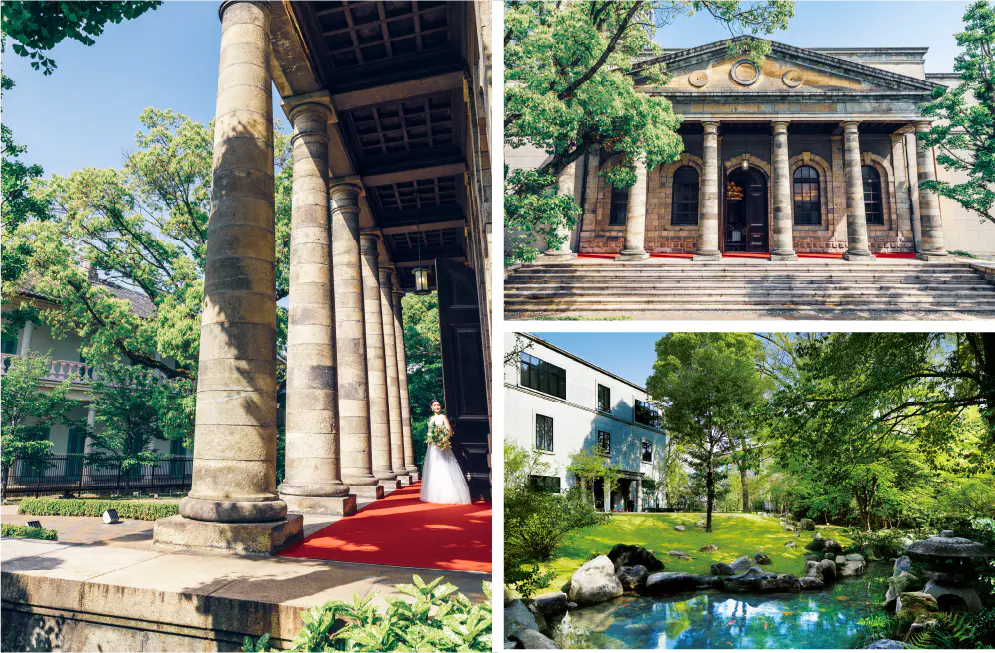

KYU-SAKURANOMIYA

KOKAIDO

Osaka, Osaka Prefecture

[KYU-SAKURANOMIYA KOKAIDO /

Meiji Emperor Memorial Hall]

[KYU-SAKURANOMIYA KOKAIDO /

Meiji Emperor Memorial Hall]

- Designated National Important Cultural Property

- Awarded the 34th Osaka Urban Landscape Architecture Award

- Awarded the Good Design Award 2014

- The Kokaido was established in 1935 as the Meiji Emperor Memorial Hall, and is the oldest Western-style building in Osaka Prefecture.

- The existing building was preserved as much as possible and opened for business in April 2013 as a restaurant and wedding facility. The Japanese-style garden has been recreated and is open to the public as a park 365 days a year.

M&A examples

Flairge

Dalliance

Omihachiman, Shiga Prefecture

[Former Wedding Hall and

Restaurant]

[Former Wedding Hall and

Restaurant]

- Kanekichi Yamamoto Foods Co., Ltd. opened this facility as a wedding venue and restaurant in 2008. It has an excellent location that enables guests to enjoy the scenery of Lake Biwa, and has a modern design akin to an art gallery.

- In 2019, we signed a lease agreement and leased the building. We subsequently rebranded it as a medium-priced private wedding venue, redecorating the interior with a clear focus.

ROYALKAILA

WEDDING

Hawaii O’ahu Island

[Former EXEO Japan subsidiary]

[Former EXEO Japan subsidiary]

- In December 2019, we acquired a US company that operates photo weddings and spas in Hawaii through M&A. We aim to improve profitability by taking advantage of our ability to send customers from NOVARESE’s wedding facilities and dress shops.

- In addition to couples wishing to hold wedding ceremonies and banquets in Japan and overseas, we are also cultivating demand for those wishing to marry without holding a conventional ceremony and banquet.

- It also has significance in terms of expanding into asset-light business operations.